|

Wonik hits the upper limit

According to KG Zeroin’s MP Doctor (formerly MarketPoint), notable gainers in the biotech sector on the day included Wonik, Jeonjin BioPharm, and Y2Solution, with their shares closing up 29.82% (₩6,400), 29.85% (₩3,415), and 6.53% (₩3,510) respectively from the previous session.

The bio sector reacted sensitively to the new administration’s policy direction. Wonik, in particular, drew investor attention amid expectations that it may benefit from the President’s aggressive push to amend the Commercial Act. Wonik Group, which controls some 30 affiliates with total assets exceeding ₩5 trillion, is effectively dominated by Wonik-whose market cap is just about ₩100 billion. Should the group be newly classified as a large business group under the revised law, Wonik’s corporate value could see a substantial boost.

Y2Solution, meanwhile, continued its rise based on positive developments in its licensing business. The company’s U.S.-based joint venture, Luxa Biotechnology, is seen as a strong contender for technology transfer deals thanks to superior clinical data compared to global competitors.

Y2Solution previously secured a 50% stake in Luxa Biotechnology, which was co-founded with the NSCI (Neural Stem Cell Institute)-the first U.S. nonprofit research organization specializing in neural stem cells. NSCI was established by Dr. Sally Temple, a global authority in stem cell research, who currently serves as Luxa’s co-founder and Chief Scientific Officer. NSCI owns technology related to the transplantation of retinal pigment epithelial (RPE) stem cells.

Luxa is currently conducting clinical trials of its stem cell-based therapy candidate RPESC-RPE-4W, developed to treat dry age-related macular degeneration (AMD) with a single injection. RPESC-RPE-4W is designed to restore vision by replacing damaged RPE cells with adult stem cells. While drug development for dry AMD has accelerated over the past 10 to 15 years, most treatments remain in early-phase trials. Existing therapies can only slow disease progression and cannot reverse vision loss-highlighting the unmet need Luxa aims to address.

Y2Solution plans to complete Phase 1/2a clinical trials for RPESC-RPE-4W within the year and enter full-scale technology licensing negotiations. The company has reportedly held tech transfer meetings with two major global pharmaceutical companies during a recent academic conference.

These developments were featured in a premium pay-to-read article by PharmEdaily, titled “Y2Solution’s U.S. JV reaches $300M valuation-What’s driving it?”, published at 9:19 a.m. on June 4. Following its release, Y2Solution’s stock price rose notably on investor optimism.

A Y2Solution spokesperson commented, “Luxa Biotechnology’s valuation continues to climb. One investment firm recently valued the company at $300 million (approximately ₩410 billion).”

|

Caution Urged on Jeonjin BioPharm Despite Stock Surge

Elsewhere, Jeonjin BioPharm also surged but drew cautionary remarks from industry insiders. Despite the sharp rise, the company has no clear value-driving developments, and ongoing management disputes add further risk.

One analyst warned, “Jeonjin BioPharm has no concrete catalysts for value growth. Given the opaque trading environment, investors may face steep losses if they act on speculation.”

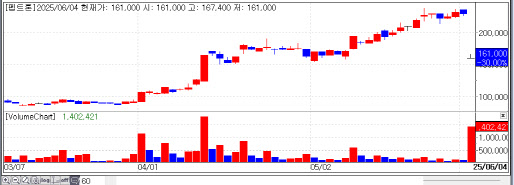

In contrast, Peptron, previously a biotech sector frontrunner, sharply declined on the same day, closing at its daily lower limit of ₩161,000 despite the broader market uptrend. The drop followed news that global pharma giant Eli Lilly had signed a long-acting drug delivery technology licensing deal with Swedish firm Camurus-raising concerns that Peptron’s own collaboration with Lilly may be at risk.

A Peptron representative clarified, “Eli Lilly’s new contract involves a different formulation method from our own SmartDepot spray-drying platform. The joint evaluation of our technology for a long-acting obesity treatment with Lilly is progressing smoothly.”

!['과대망상'이 부른 비극…어린 두 아들 목 졸라 살해한 母[그해 오늘]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021700001t.jpg)