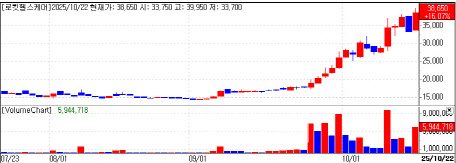

According to KG Zeroin, Rokit Healthcare closed at 38,650 won, up 16% from the previous day. The stock has been on a remarkable climb since early September, jumping from around 14,000 won to the upper 30,000-won range. The rally comes after the company announced that it had received public insurance reimbursement in the U.S. for its diabetic foot regeneration treatment.

|

The firm noted that official recognition in the U.S. implies both safety and efficacy validation. This development has sparked expectations that commercialization of Rokit Healthcare’s AI organ-regeneration platform will expand not only across the U.S. but also in Europe and the Middle East. The company combines AI, medical 3D bioprinting, and single-use medical kits to develop regenerative treatments for diabetic patients’ feet. Its technology uses autologous tissue-derived extracellular matrix (ECM) printed into patch form for wound coverage, achieving an average 82% regeneration success rate. Treatment costs are estimated at one-fourth of traditional diabetic foot surgery or wound care methods.

CEO You Seok-hwan stated, “This is the first case of an AI-based regenerative medical procedure being incorporated into the U.S. official insurance system. We expect global insurance approvals to accelerate rapidly. Rokit Healthcare aims to usher in the era of personalized regenerative medicine, moving beyond mass treatment approaches.”

|

Under the new MOU, the two companies will collaborate on next-generation formulations of mirodenafil, joint global trials, and AR1001’s commercial manufacturing and export. The agreement reflects their shared confidence in the ongoing Phase 3 program and the drug’s commercialization potential. AriBio’s POLARIS-AD Phase 3 study has enrolled 1,535 patients across the U.S., Europe, Korea, and China. The company plans to complete the trial in the first half of 2026, disclose top-line results, and submit a New Drug Application (NDA) to the U.S. FDA by the end of the same year.

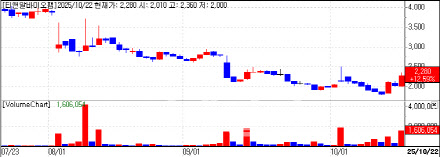

Meanwhile, T&R Biofab closed at 2,280 won, up 13% from the previous session. The company’s rising stock price has been supported by investor confidence in its capital increase and new product outlook. T&R Biofab announced that its rights offering achieved an oversubscription rate of 102.15%, with strong participation from existing shareholders. The offering totaled 15.9 million new shares, with total subscriptions reaching 16.2 million shares. Foreign investors have also been net buyers for five consecutive trading days, accumulating approximately 437,400 shares.

![조상님도 물가 아시겠죠… 며느리가 밀키트 주문한 이유[사(Buy)는 게 뭔지]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021500087t.jpg)

![설에 선물한 상품권, 세금폭탄으로 돌아온 까닭은?[세상만사]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021500108t.jpg)

!['36.8억' 박재범이 부모님과 사는 강남 아파트는[누구집]](https://image.edaily.co.kr/images/vision/files/NP/S/2026/02/PS26021500062t.jpg)