|

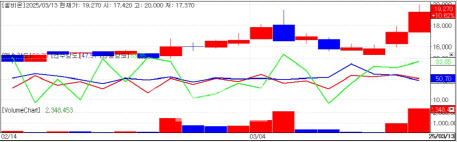

On March 13, radio pharmaceutical therapy(RPT) stocks showed significant gains. CellBion, which debuted on KOSDAQ last year, jumped 10.6%, while FutureChem hit an intraday high of 23,450 won before closing 0.8% higher at 22,700 won.

Their surge was fueled by growing interest in RPTs, further boosted by a freely available PharmEdaily article, “The Battle for Radiopharmaceuticals: CellBion vs. FutureChem”.

According to the report, both CellBion and FutureChem are in late-stage Phase 2 clinical trials in South Korea for their castration-resistant prostate cancer(mCRPC) treatments, Lu-177-DGUL and FC705, respectively. These two drug candidates have been designated orphan drugs and are eligible for the global innovative expedited review process by the Ministry of Food and Drug Safety(MFDS), allowing them to apply for conditional approval upon completion of Phase 2 trials.

The market has already seen success in radio pharmaceuticals, with Novartis’ Pluvicto proving its commercial viability. As latecomers, CellBion and FutureChem are emphasizing their key differentiators from Pluvicto. CellBion’s Lu-177-DGUL showed a higher objective response rate (ORR) than Pluvicto in Phase 2 trials, indicating superior efficacy with fewer side effects.

FutureChem’s FC705 demonstrated a reduction in prostate-specific antigen (PSA) levels, suggesting it may match Pluvicto’s efficacy at half the dosage. CellBion aims to complete its Phase 2 trials by mid-year and launch its product in October 2024. FutureChem is conducting trials in both South Korea and the United States, with commercialization expected as early as early 2025. Both companies are seeking global licensing-out deals, with some analysts projecting potential deals in the trillion-won range.

|

Orum Therapeutics which listed on KOSDAQ on Feb. 14, once peaked at 42,250 won but has struggled amid selling pressure. With 28.91% of total issued shares set to be released from the lock-up period on March 14, the stock has continued to decline.

Since Feb. 28, Orum has fallen in eight of the last nine trading sessions, with only one exception. For many newly listed KOSDAQ companies the end of the one-month lock-up period is a critical turning point, making March 14 an important test for Orum. The market is closely watching whether the company can demonstrate strong growth momentum to counterbalance the expected sell-off.

Investor expectations remain high regarding potential major licensing deals later this year. Orum’s pre-IPO investment prospectus indicated that it anticipates securing an additional global tech transfer deal this year, with an upfront payment of about 23.5 billion won.

This anticipated deal centers on TPD², the company’s proprietary targeted protein degradation (TPD) platform, which it successfully licensed out to Vertex Pharmaceuticals last year.

An Orum spokesperson said “The deal referenced in the investment prospectus pertains to TPD². We are actively engaged in business development discussions with potential partners, but we cannot disclose details on the progress.”

HLB Group Stocks Continue Slide With One Week Until FDA Decision

With just one week remaining before the FDA’s new drug application decision on the rivoceranib + camrelizumab combination therapy for liver cancer, HLB Group stocks have been volatile.

On March 13, all 11 HLB Group stocks declined, including Anygen, a company HLB recently announced plans to acquire.

Key declines among HLB Group stocks △HLB -5.5% to 74,200 won △HLB Therapeutics -9.2% to 8,080 won (largest decline in the group) △HLB Life Science -8.6% △HLB Pharma -6.8% △HLB Biostep -5.1% △HLB Global -4.6% △HLB Science -0.5% (smallest decline).

The FDA decision is critical not only for HLB and rivoceranib, but for the entire HLB Group, as several subsidiaries are directly involved in the drug’s commercialization and financing:

HLB Life Science holds South Korean marketing rights for rivoceranib. HLB Pharma plans to seek regulatory approval from South Korea’s Ministry of Food and Drug Safety and handle domestic production and marketing if the FDA grants approval.

Other HLB affiliates have invested in rivoceranib’s development, sharing the financial burden. The FDA’s ruling on rivoceranib + camrelizumab is considered one of the most significant events for South Korea’s biotech sector in the first half of 2024. If approved HLB aims to launch the drug in the U.S. by the third quarter.

An HLB spokesperson cautioned against speculation saying “As the NDA decision date approaches, rumors will intensify. The FDA has not made any decision yet. We will announce the official decision on YouTube as soon as we receive notification, so please do not be swayed by unfounded rumors.”